Bonds rallied, Gold rallied, as did Oil (though it pulled back on Friday).

This week TWTR rallied on takeover rumors. ADBE FDX, RHT, popped on earnings

WFC dropped on consumer fraud news, FB dropped on false ad info...

All time lows:

Mergers/Deals:

Options watch: Implied Volatility now rising... Link to high IVR stocks

High volume: SPY, IWM, QQQ, AAPL, FB, BAC, GLD, GDX, USO, VXX, XLF, FXI, EEM EWZ, XOP

Next week: Economic reports, End of 3rd Quarter -big gains this quarter.

CBOE VIX -rising

10yr Interest Rates -rising?

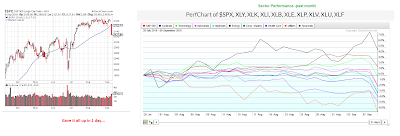

ETFs - Ranked by YTD Percent Change

Natural Gas was unchanged, closing near 2.96

Crude Oil was up, closing near 44.59

Gold was up, closing near 1341

The 30 year Bond rallied, closing near 167.72

The US Dollar was down, closing near 95.41

NEWS:

Fitch warns bad debts in China are ten times official claims, state rescue urgent